It is possible to wonder how much money you can save in your savings account. In this article, we'll look at the average balance for a savings account, the Three to Six Month Rule of Thumb, and what kind of fees you might be charged for holding your money. Next, we'll discuss how to select the best savings account. The average savings account balance is $41,600. Next, we'll discuss fees and interest rates to help us choose the right one.

Average savings account balance of $41,600

The average American household now has $41,600 in savings, up from $53,300 in 2012. According to Bankrate's survey. The median amount in a savings account is dependent on the age. The 2019 Survey of Consumer Finances (triennial survey) only includes households with active transactions accounts. However, the average savings account balance is $41,600. The dollar amounts are in 2019 dollars. This data is a good indication of the financial stability of the average American.

According to the US Federal Reserve, Americans have a $41,600 average savings account balance. This compares with $5,300 in 2012. The median savings account balance in America is now just $16,000, according to the US Federal Reserve's latest survey of consumer finances. This is down from $5,300 in 2012. The survey found that the average savings rate of American households is 4.4%. This is significantly lower than the previous year's 6%.

The thumb rule is three to six months

The standard recommendation of having three to six months worth of savings in your savings account is good. But your lifestyle and expenses can affect the amount you have in your savings account. It is a good idea to save at least three to six monthly essential expenses. This number can be higher for households with lower incomes. To calculate your exact savings amount, review your bank statements and add up your essential bills. These include rent and insurance premiums as well as debt repayments. You can also spend money on groceries or transportation. It is best to have three to six month's worth of expenses saved.

One of the best ways to calculate your emergency savings is to budget your expenses. If you have a steady job, you can save less than three to six months of expenses, but if you're self-employed, you'll want to have extra padding in case of a major emergency. Single parents will want to save at least one year's worth of expenses, while married couples with dual incomes should save up three to six months of income each. Investors should consider all of these factors, too.

Interest rate on savings account

The interest rate on your savings bank account is calculated daily using the lowest balance. According to their schedules, banks calculate your interest monthly, quarterly, and half-yearly. Interest is paid on the monthly balance on last day of the month. If you hold your savings account for longer periods of time, you can get a higher rate.

Variable Interest Rates for Savings Accounts allow banks to adjust the rate at their discretion. The more competition there is, the more variable the savings account interest rates. Savings account rates are regulated by the Reserve Bank of India up until 2011 when banks started offering higher interest rates to lure customers. Below is a table showing the rates of savings accounts at their highest and lowest.

Saver's account fees

Knowing how much are fees on savings accounts is important if you want to make the most of your money. Many banks fail to clearly disclose their fees and charges. This can reduce your balance and impact the amount of interest you earn. Most banks will inform you about maintenance charges, but not all banks. Other fees are often hidden in fine print and difficult to find. It is important that you understand all fees associated with your account before you sign up.

If you make more than six withdrawals per month, you may be charged an excess transaction fee. If you withdraw more than the federal maximum from your savings accounts, this is an additional fee. You can withdraw up to six times each month free of charge, but it is possible to waive this fee if you have the coronavirus epidemic. This fee could reach as high $30. If you regularly check your account balance, you may be able to avoid these fees. Overdrafts are not without risks. Direct deposit may be a better option than overdrafts if you have concerns. This service can help you keep your account balance low, which will avoid overdraft fees.

FAQ

What are some easy ways to make money online?

There are many different ways to make online money. These are some ideas that you might not have considered.

-

Become an affiliate marketer

-

Sell your products

-

Start a blog

-

You can create a course

-

Write articles

-

Promote Other People's Products

-

Offer Consulting Services

-

Teach Online Courses

How much do online affiliate marketers make?

An online affiliate marketer's average annual income is between $0-$100k.

Most of these people are self employed and have their own websites.

They promote products using a variety of methods, including text links, banner ads, contextual advertising and search engine optimization (SEO), as well as social media marketing.

Affiliates can earn anywhere from $50 to $100 per sale.

Affiliates can make as much as $1000 for each sale.

What is the difference in web hosting and cloud hosting

Web hosting means storing data on servers that are located in a specific place. Cloud hosting is the storage of data on remote servers that can be accessed via the internet.

What will it take to make money online by 2022?

Many people are now working remotely due to the coronavirus epidemic. This allows you to control your own schedule and save time traveling. However, there are still plenty of jobs out there that require physical presence. If you want to live the dream of being your boss, here are some ways to make money online.

1. Sell your products

2. Be an affiliate marketer

3. Start a new blog

4. Offer freelance services

5. Create digital designs

6. Write articles

How can I earn fast money online?

There are many opportunities to make money online. You could try affiliate marketing, blogging, and selling products on Amazon, eBay or Etsy.

Another option is to set up an ecommerce site where you can sell physical goods such as clothes, books, electronics, toys and other items.

You can make a lot of money by having any type of experience.

Are there other great affiliate networks?

Yes! Yes. There are many other trusted affiliate networks. ShareASale and CJ Affiliate are just a few examples.

They all pay between $10-20 per sale. You will find many tools and features available to assist affiliates in their success.

Do I have to pay for hosting on sites such as WordPress.org?

No. Free hosting sites do not allow you to customize your website design.

These restrictions also limit how many visitors you can send your site.

Statistics

- According to research by Marketo, multimedia texts have a 15% higher click-through rate (CTR) and increase campaign opt-ins by 20%. (shopify.com)

- According to the Baymard Institute, 69.82% of shopping carts are abandoned. (shopify.com)

- BigCommerce affiliate program , you receive a 200% bounty per referral and $1,500 per Enterprise referral, with no cap on commissions. (bigcommerce.com)

- One of the most well known sites is the Amazon affiliate program, Amazon Associates , which boasts the largest market share of affiliate networks (46.15%). (bigcommerce.com)

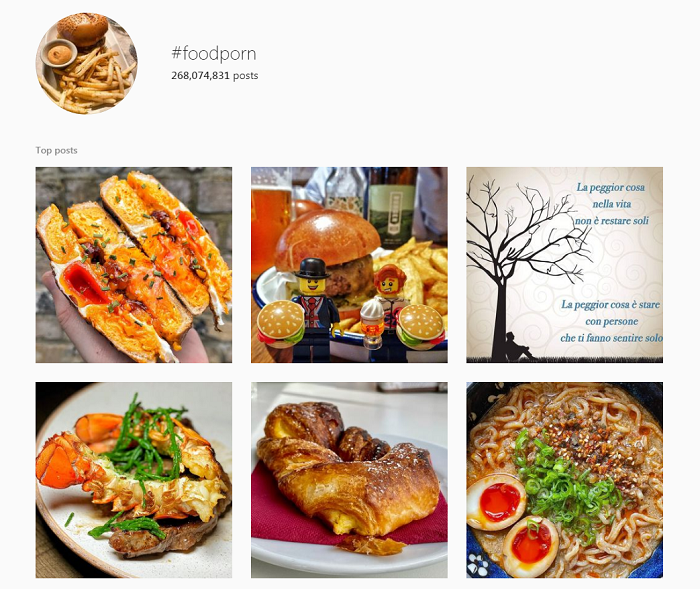

- Instagram is the most popular channel, with 67% of brands using it. (shopify.com)

External Links

How To

There are pros and cons to affiliate marketing

Affiliate marketing refers to performance-based advertising where affiliates get compensation from advertisers when they bring traffic to their sites. The most popular type of affiliate marketing is pay per click (PPC). Other forms of marketing include cost/per-action (CPA), CPL (cost per lead), and CPS (cost per sale).

This marketing method is a great way to get sales. Affiliates don't have to be experts in any particular field. Affiliates only require a website and promotional materials. However, affiliate marketing also has many drawbacks. To make money, you need to have many visitors to your website. You will also need to devote time creating content and marketing your site. It is also difficult to establish and maintain affiliate programs. This means that most affiliates start small before expanding into full-time companies.

Pros:

-

It's easy to get started with no upfront investment required.

-

There is no long-term commitment.

-

Low risk

-

Scale easily

-

Can be used for beginners.

-

You don't need to know the business model.

-

It can be used for passive income generation.

-

Customer support is not something you need to worry about.

-

It allows for you to design a flexible timetable.

-

You can work from anywhere.

Cons:

-

It takes time to grow.

-

You might find it difficult to compete with larger businesses.

-

It takes patience.

-

It's not appropriate for everyone.

-

You cannot control the product quality you promote.

-

It is difficult for you to measure your results.

-

It can be expensive to run if your don't understand what you're doing

Affiliate marketing can be a great way of making money online. It's one of the easiest types of online entrepreneurship to start, but it takes a lot of effort and dedication to succeed. To learn more about affiliate marketing, check out the following posts: